Maximize Savings in 2025: Top 3 Personal Finance Tips for US Residents

Maximize Your Savings: 3 Personal Finance Tips for US Residents in 2025 focuses on practical strategies to enhance financial well-being, including budgeting, investment planning, and debt reduction, tailored for the economic landscape of the United States.

Ready to take control of your finances and boost your savings in the coming year? This article unveils Maximize Your Savings: 3 Personal Finance Tips for US Residents in 2025, equipping you with actionable strategies to achieve your financial goals.

Creating a Budget That Works for You

Creating a budget is one of the cornerstones of effective personal finance, but often it feels like a daunting task. The key is to make your budget realistic and adaptable to your individual circumstances. Let’s explore how to make budgeting work for you.

Understanding Your Income and Expenses

Start by listing all sources of income. Then, track your expenses for a month to identify where your money is going, categorizing them into fixed (e.g., rent) and variable (e.g., groceries) costs.

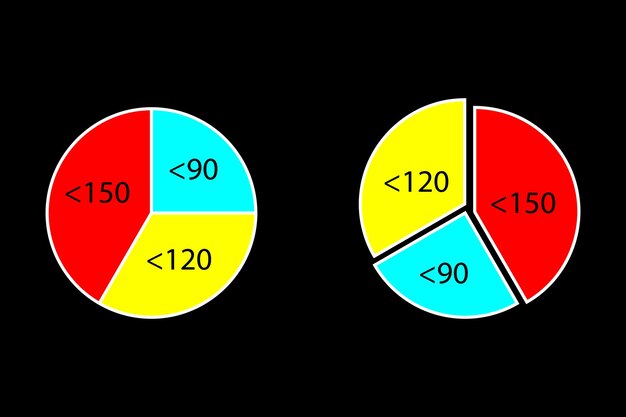

The 50/30/20 Rule

A popular budgeting method, the 50/30/20 rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Regularly review and adjust your budget as your income or expenses change.

- Use budgeting apps or spreadsheets to automate tracking and analysis.

- Set realistic financial goals and break them down into smaller, manageable steps.

- Don’t be afraid to seek professional advice if you are struggling to manage your budget effectively.

A working budget can empower you to make informed decisions, control your spending, and achieve your financial aspirations.

Investing for the Future

Investing is essential to help your money grow over time, but it’s easy to be intimidated by the seemingly complex world of stocks, bonds, and mutual funds. It is important to understand investing, especially for long-term goals like retirement.

Starting Early

The earlier you start investing, the more time your money has to grow through the power of compounding. Even small, consistent investments can yield significant returns over decades.

Diversifying Your Investments

Diversification helps reduce risk by spreading your investments across various asset classes, industries, and geographic regions. This way, if one investment performs poorly, others can offset the losses.

Retirement Accounts

Take full advantage of tax-advantaged retirement accounts, such as 401(k)s and IRAs. These accounts offer tax benefits that can significantly boost your long-term savings.

- Consider target-date funds, which automatically adjust their asset allocation as you approach your retirement date.

- Consult a financial advisor to create an investment strategy tailored to your risk tolerance and goals.

- Continuously educate yourself about investing and stay informed about market trends.

- Rebalance your investment portfolio periodically to maintain your desired asset allocation.

Investing is a journey, not a sprint, so start now and stay the course to achieve your long-term financial goals.

Debt Reduction Strategies

Managing and reducing debt is a critical aspect of personal finance, as high interest rates can hinder your ability to save and invest. Let’s explore proven strategies for tackling debt effectively. Minimizing debt can significantly improve your financial health.

Prioritizing High-Interest Debt

Focus on paying off debts with the highest interest rates first, such as credit card balances. This can save you significant amounts of money over time.

The Debt Snowball Method

The debt snowball method involves paying off your smallest debts first, regardless of interest rate, to gain momentum and motivation. This psychological boost can encourage you to stay on track.

Negotiating Lower Interest Rates

Contact your creditors to negotiate lower interest rates on your existing debts. Some creditors may be willing to work with you to lower your payments or offer a balance transfer to a lower-rate card.

- Create a detailed debt repayment plan and track your progress regularly.

- Consider consolidating your debts with a personal loan or balance transfer to simplify repayment.

- Avoid taking on new debt while you are working to pay off existing debts.

- Seek financial counseling if you are struggling to manage your debt on your own.

Reducing debt can be a challenging but rewarding journey. By implementing these strategies, you can regain control of your finances and achieve your financial goals.

Emergency Fund Establishment

An emergency fund serves as a financial safety net, providing funds for unexpected expenses like medical bills or job loss. It is crucial to have an emergency fund to protect you from financial crises.

Target Savings Amount

Aim to save at least three to six months’ worth of living expenses in your emergency fund. This provides a cushion to cover essential costs during difficult times.

Easy Access Savings

Keep your emergency fund in a high-yield savings account or other liquid account where you can easily access the funds when needed, but are less tempted to spend them.

Automatic Savings Setup

Set up automatic transfers from your checking account to your savings account each month to gradually build your emergency fund. Small, consistent contributions can add up over time.

An emergency fund gives you peace of mind and protects you from financial setbacks. Prioritize establishing this essential financial buffer.

How to Track Your Progress

Tracking your progress is essential to achieve your personal finance goals. Regular monitoring of your finances helps you stay on track and make necessary adjustments.

Monthly Financial Review

Schedule a monthly review of your budget, investments, and debt repayment progress. This provides an opportunity to assess your financial situation and identify areas for improvement.

Using Financial Apps

Utilize financial apps or spreadsheets to track your net worth, monitor your spending habits, and set financial goals. These tools can provide valuable insights and help you stay organized.

Seek Professional Advice

Don’t hesitate to seek advice from a qualified financial advisor who can provide personalized guidance based on your unique circumstances. Professional advice can help you make informed decisions.

Tracking your financial progress is key to long-term success. By regularly monitoring your finances, you can ensure you are moving toward your financial goals.

Adapting to Economic Changes

The economic landscape is ever-changing, and it’s essential to adapt your financial strategies to navigate new challenges and opportunities. Flexibility and adaptability are key to continued financial success.

Stay Informed

Stay informed about economic trends, interest rate changes, and tax law updates, as these can significantly impact your personal finances. Knowledge is power when it comes to managing money.

Adjust Your Strategies

Be prepared to adjust your investment and savings strategies as needed. For example, during economic downturns, it may be prudent to reduce risk in your investment portfolio or increase your emergency fund.

Seek Professional Guidance

Consult trusted advisors, such as financial planners and tax professionals, to help you adapt your financial plan to changing economic conditions. They can provide expert guidance.

Adapting to economic changes is essential to maintaining financial stability and achieving your long-term goals. Stay flexible and informed.

| Key Point | Brief Description |

|---|---|

| 📊 Budgeting | Create a detailed budget by categorizing income and expenses. |

| 📈 Investing | Diversify investments and start early to maximize growth. |

| 📉 Debt Reduction | Prioritize paying off high-interest debt and negotiate rates. |

| 💰 Emergency Fund | Save 3-6 months of living expenses in an easily accessible account. |

Frequently Asked Questions

▼

The first step is to track your current income and expenses for at least one month. This helps you understand where your money is going.

▼

Starting early allows your investments to grow over time due to compounding, yielding greater returns in the long run, especially for retirement.

▼

It is a debt reduction strategy where individual pays off the smallest debts first to create gradual momentum and motivation for future debt management.

▼

You should aim to save at least three to six months’ worth of living expenses in your emergency fund to cover unexpected costs.

▼

It is advisable to review your investments at least once a year or when there are significant changes to your financial situation.

Conclusion

In conclusion, mastering your personal finances is crucial for a secure future. By crafting a realistic budget, investing wisely, managing debts effectively, and establishing an emergency fund, US residents can pave the way for financial freedom and achieve their long-term goals. Stay informed, adapt your strategies as needed, and take control of your financial future today.