Diversification Strategies: Optimize Portfolio Allocation for Returns

Diversification strategies involve allocating your investment portfolio across various asset classes, such as stocks, bonds, and real estate, to optimize returns while minimizing risk, tailored to your unique financial goals and risk tolerance.

Investing wisely means understanding how to manage risk and maximize potential returns. One of the most effective tools for achieving this balance is through diversification strategies: how to allocate your portfolio across different asset classes for optimal returns, ensuring you’re not overly exposed to any single market fluctuation.

Understanding diversification strategies: an essential investment approach

Diversification is a cornerstone of sound investment management, acting as a safeguard against market volatility. It involves spreading investments across a variety of asset classes to reduce the risk associated with any single investment.

By not putting all your eggs in one basket, you protect your portfolio from severe losses should one sector or asset class underperform. This approach aims to smooth out returns over time, providing a more stable investment experience.

The importance of diversification

Diversification is crucial for several reasons. It mitigates risk, enhances returns, and provides peace of mind. Understanding these benefits can help you make informed decisions about your investment strategy.

- Risk Mitigation: Spreading investments across different asset classes reduces the impact of any single investment’s poor performance on your overall portfolio.

- Enhanced Returns: Diversification allows you to participate in the growth potential of various sectors and asset classes, increasing your chances of achieving higher returns.

- Peace of Mind: Knowing that your portfolio is diversified can provide a sense of security and reduce anxiety associated with market fluctuations.

Diversification is not a guarantee against loss, but it significantly lowers the potential for catastrophic losses. It’s a strategic approach to managing risk while pursuing growth opportunities.

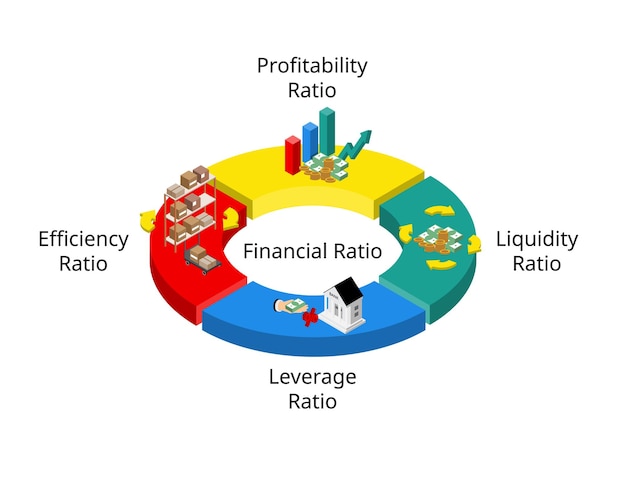

Asset classes: the building blocks of a diversified portfolio

Asset classes are categories of investments that share similar characteristics and behave similarly in the marketplace. Common asset classes include stocks, bonds, real estate, and commodities.

Understanding the unique attributes of each asset class is essential for constructing a well-diversified portfolio. Each class offers different levels of risk and potential return, allowing investors to tailor their portfolio to their specific goals and risk tolerance.

Stocks

Stocks represent ownership in a company and offer the potential for high returns. However, they also come with higher risk compared to other asset classes. Stocks can be further divided into categories like large-cap, mid-cap, and small-cap stocks, each with its own risk-reward profile.

Bonds

Bonds are debt securities issued by governments or corporations. They typically offer lower returns than stocks but are also less volatile. Bonds are considered a more conservative investment option, providing a steady stream of income.

Real Estate

Real estate involves investing in physical properties, such as residential or commercial buildings. It can provide both income and capital appreciation. Real estate is often seen as a hedge against inflation and can offer diversification benefits.

Different asset classes react differently to economic conditions. A diversified portfolio aims to balance these reactions, reducing overall volatility.

Assessing your risk tolerance and investment goals

Before creating a diversified portfolio, it’s important to assess your risk tolerance and define your investment goals. These factors will influence the asset allocation strategy that’s right for you.

Risk tolerance refers to your ability and willingness to withstand fluctuations in the value of your investments. Investment goals are the financial targets you hope to achieve through your investments, such as retirement, education, or purchasing a home.

- Conservative: Investors with a low risk tolerance may prefer a portfolio heavily weighted in bonds and other low-risk assets.

- Moderate: Investors with a moderate risk tolerance may opt for a balanced portfolio with a mix of stocks and bonds.

- Aggressive: Investors with a high risk tolerance may allocate a larger portion of their portfolio to stocks and other growth-oriented assets.

Your investment goals should also be specific, measurable, achievable, relevant, and time-bound (SMART). This clarity helps in selecting the right asset allocation strategy.

Asset allocation strategies: balancing risk and return

Asset allocation is the process of dividing your investment portfolio among different asset classes. The goal is to create a portfolio that aligns with your risk tolerance and investment goals.

Effective asset allocation involves considering the characteristics of each asset class, as well as your individual circumstances. Different strategies can be employed based on your specific needs and preferences.

The 60/40 portfolio

A 60/40 portfolio is a traditional asset allocation strategy that consists of 60% stocks and 40% bonds. It’s often considered a balanced approach, providing a mix of growth potential and income.

The all-weather portfolio

An all-weather portfolio is designed to perform well in various economic conditions, including inflation, deflation, economic growth, and recession. It typically includes a mix of stocks, bonds, commodities, and gold.

Target-date funds

Target-date funds are designed for investors who are saving for retirement. These funds automatically adjust their asset allocation over time, becoming more conservative as the target date approaches.

Asset allocation is not a one-time decision. It should be reviewed and adjusted periodically to ensure it continues to align with your goals and risk tolerance.

Diversification beyond asset classes: sector and geographic considerations

Diversification can be further enhanced by considering sector and geographic diversification. This involves spreading investments across different industries and countries to reduce concentration risk.

Sector diversification involves investing in companies from various industries, such as technology, healthcare, and consumer staples. Geographic diversification involves investing in companies from different countries or regions.

Sector diversification

Investing in a variety of sectors can help protect your portfolio from sector-specific risks. For example, if you only invest in technology stocks, your portfolio could be significantly impacted by a downturn in the technology sector.

Geographic diversification

Investing in companies from different countries can help protect your portfolio from country-specific risks. Economic or political instability in one country could negatively impact your investments in that country.

Diversifying across sectors and geographies can provide additional layers of protection against unforeseen events.

Rebalancing your portfolio: maintaining your strategic allocation

Rebalancing involves periodically adjusting your portfolio to maintain your desired asset allocation. Over time, certain asset classes may outperform others, causing your portfolio to drift away from its original allocation.

Rebalancing ensures that your portfolio remains aligned with your risk tolerance and investment goals. It involves selling assets that have increased in value and buying assets that have decreased in value to restore your target allocation.

- Calendar-based rebalancing: Rebalancing at regular intervals, such as quarterly or annually.

- Threshold-based rebalancing: Rebalancing when the allocation of an asset class deviates by a certain percentage from its target allocation.

Rebalancing can also help you take advantage of market opportunities by selling high and buying low. It’s a disciplined approach to maintaining your investment strategy.

| Key Point | Brief Description |

|---|---|

| ⚖️ Risk Mitigation | Diversifying reduces the impact of poor performance from a single asset. |

| 📈 Enhanced Returns | Participate in various sectors and asset classes to increase potential returns. |

| 🎯 Asset Allocation | Divide portfolio among different asset classes based on risk tolerance and goals. |

| 🔄 Rebalancing | Adjust portfolio periodically to maintain desired asset allocation. |

Frequently Asked Questions About Diversification

▼

Diversification involves spreading investments across different assets to reduce risk. It’s crucial because it minimizes the impact of any single investment’s poor performance on your overall portfolio.

▼

The main asset classes include stocks, bonds, real estate, and commodities. Each has different risk and return characteristics, allowing you to balance your portfolio.

▼

Consider your investment timeline, financial goals, and comfort level with market fluctuations. A conservative investor may prefer lower-risk assets like bonds.

▼

Asset allocation is dividing investments among asset classes based on risk tolerance and financial goals. Diversification is a key part of asset allocation, reducing overall portfolio risk.

▼

Rebalance periodically, such as quarterly or annually, or when an asset class deviates significantly from its target allocation. This keeps your portfolio aligned with your goals.

Conclusion

Implementing diversification strategies is a proactive step towards achieving long-term financial security and stability, ensuring your portfolio can weather various market conditions while pursuing optimal returns tailored to your individual needs and risk profile.