5 Proven Personal Finance Tips for US Families in 2025

5 Personal Finance Tips for US Families to Achieve Financial Stability includes budgeting, emergency funds, debt management, investing, and insurance to protect your assets and secure your future.

Achieving financial stability can seem daunting, but with the right strategies, 5 Personal Finance Tips for US Families to Achieve Financial Stability is within reach. These actionable steps can help you build a solid financial foundation.

Create a Realistic Budget

Budgeting is the cornerstone of financial stability. It allows you to track your income and expenses, ensuring you’re not spending more than you earn. Understanding your cash flow is the first step towards controlling your finances.

Start by listing all sources of income your family has. Then, categorize your expenses into fixed (rent, mortgage, insurance) and variable (groceries, entertainment) costs. There are several budgeting methods you can use, such as the 50/30/20 rule or zero-based budgeting.

Track Your Spending

To create an effective budget, you need to know where your money is going. Use budgeting apps, spreadsheets, or even a notebook to track your expenses. Categorize each expense to identify areas where you can cut back.

Set Financial Goals

Your budget should align with your financial goals. Whether it’s saving for a down payment on a house, paying off debt, or investing for retirement, setting clear goals will motivate you to stick to your budget.

- Review your budget regularly and make adjustments as needed.

- Involve your family in the budgeting process to foster financial awareness and responsibility.

- Use budgeting tools like Mint or YNAB to automate tracking and gain insights.

By creating a realistic budget, families can gain control over their finances, identify areas for improvement, and work towards achieving their financial goals. It’s about making informed decisions and creating a roadmap for financial stability.

Build an Emergency Fund

An emergency fund is a safety net that protects you from unexpected expenses like medical bills, car repairs, or job loss. Without it, you might be forced to take on debt or dip into your long-term savings. Building an emergency fund is crucial for weathering financial storms.

Start by setting a savings goal. Aim for 3-6 months’ worth of living expenses in a readily accessible account, such as a high-yield savings account. Automate your savings by setting up recurring transfers from your checking account to your emergency fund.

Determine Your Savings Goal

Calculate your monthly living expenses, including rent, utilities, groceries, and transportation. Multiply that amount by 3 to 6 to determine your target emergency fund balance. Adjust the goal based on your risk tolerance and job security.

Automate Your Savings

Set up automatic transfers from your checking account to your savings account each month. Even small amounts can add up over time. Consider using apps like Acorns or Digit to automate your savings based on your spending habits.

- Prioritize building your emergency fund over other financial goals until you reach your target.

- Keep your emergency fund separate from your other savings accounts.

- Replenish your emergency fund after using it for an unexpected expense.

Building an emergency fund provides peace of mind and protects families from financial emergencies. It’s a critical component of a solid financial plan, ensuring you’re prepared for the unexpected.

Manage and Reduce Debt

Debt can be a significant obstacle to financial stability. High-interest debt, like credit card debt, can drain your income and make it difficult to save for the future. Managing and reducing debt is essential for achieving financial freedom.

Start by listing all your debts, including the outstanding balance, interest rate, and minimum payment. Prioritize paying off high-interest debt first using methods like the debt avalanche or debt snowball. Consider consolidating your debt or balance transfers to lower interest rates.

Prioritize High-Interest Debt

Focus on paying off debt with the highest interest rates first. This will save you money in the long run. The debt avalanche method involves paying the minimum on all debts except for the one with the highest interest rate, which you pay as much as possible on.

Consider Debt Consolidation

Debt consolidation involves taking out a new loan to pay off multiple debts. This can simplify your payments and potentially lower your interest rate. Options include personal loans, balance transfer credit cards, or home equity loans.

The debt snowball method involves paying off the smallest debt first for a psychological victory, which can motivate you to continue paying off larger debts.

- Negotiate lower interest rates with your creditors.

- Avoid taking on new debt while paying off existing debt.

- Use a debt management plan from a reputable credit counseling agency.

Managing and reducing debt frees up income, reduces financial stress, and allows families to focus on building wealth. It’s a crucial step towards financial stability that empowers you to control your financial future.

Start Investing Early

Investing is a powerful tool for building long-term wealth. By investing early and consistently, you can take advantage of compounding returns, allowing your money to grow exponentially over time. Investing doesn’t have to be complicated; it’s about making informed decisions and staying disciplined.

Consider opening a retirement account, such as a 401(k) or IRA, and taking advantage of employer matching contributions. Diversify your investments by investing in a mix of stocks, bonds, and mutual funds. Start small and gradually increase your contributions as your income grows.

Understand Your Risk Tolerance

Determine your risk tolerance before investing. This will help you choose investments that align with your comfort level. Younger investors typically have a higher risk tolerance, while those closer to retirement may prefer more conservative investments.

Diversify Your Investments

Diversification reduces risk by spreading your investments across different asset classes. This means investing in a mix of stocks, bonds, and real estate. Consider using index funds or ETFs to easily diversify your portfolio.

- Take advantage of tax-advantaged retirement accounts like 401(k)s and IRAs.

- Rebalance your portfolio periodically to maintain your desired asset allocation.

- Seek professional advice from a financial advisor if needed.

Starting and investing early enables families to take advantage of compounding returns, building wealth over time. It ensures a more secure financial future and the ability to achieve long-term financial goals like retirement.

Protect Your Assets with Insurance

Insurance protects your assets from unexpected events like accidents, illnesses, or natural disasters. Having adequate insurance coverage can prevent financial ruin and provide peace of mind. Review your insurance policies regularly to ensure they meet your needs.

Assess your insurance needs and purchase policies that cover your home, health, auto, and life. Consider umbrella insurance for additional liability coverage. Shop around for the best rates and coverage options.

Assess Your Insurance Needs

Determine the types of insurance you need based on your specific circumstances. This may include homeowners insurance, renters insurance, health insurance, auto insurance, and life insurance. Consider factors like your age, health, and assets when making decisions.

Shop Around for the Best Rates

Compare quotes from multiple insurance companies to find the best rates and coverage options. Use online tools or work with an independent insurance agent to simplify the process. Don’t just focus on price; consider the policy’s coverage and deductibles.

Consider disability insurance to protect your income if you become unable to work due to illness or injury.

- Review your insurance policies annually to ensure they still meet your needs.

- Increase your deductible to lower your premiums if you can afford to pay more out-of-pocket.

- Consider bundling your insurance policies with the same company for discounts.

Protecting assets with insurance safeguards families from financial losses due to unexpected events. Adequate coverage provides financial security and peace of mind, ensuring stability in the face of adversity.

Regular Financial Check-Ins

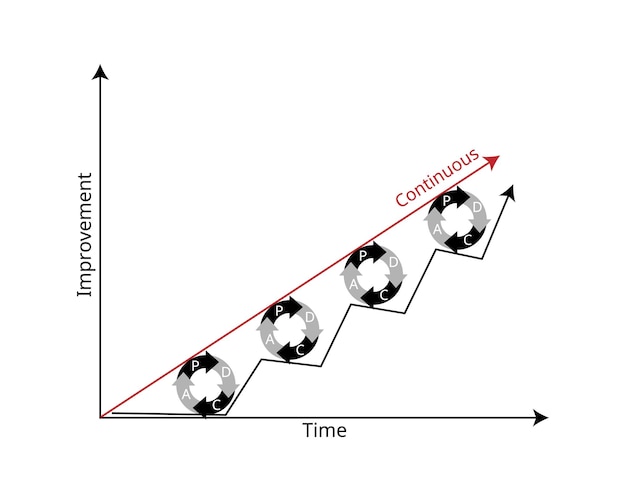

Financial stability isn’t a one-time achievement but an ongoing process. Regular financial check-ins are essential to stay on track, adjust strategies as needed, and ensure you’re making progress towards your goals. Routine reviews help you detect and address financial issues early.

Schedule monthly or quarterly financial check-ins to review your budget, track your progress, and make any necessary adjustments. Use tools like spreadsheets or budgeting apps to monitor your finances. Discuss your financial goals with your partner or family members to maintain alignment.

Review Your Budget Regularly

Go over your budget each month to see if you’re sticking to your spending plan. Identify areas where you’re overspending and make adjustments. Ensure your budget reflects any changes in your income or expenses.

Track Your Progress Towards Goals

Monitor your progress towards your financial goals, such as paying off debt, saving for retirement, or building an emergency fund. Celebrate milestones and make adjustments to your strategy if you’re not on track.

- Use financial planning software or apps to track your net worth and financial health.

- Consult with a financial advisor annually to review your overall financial plan.

- Stay informed about changes in tax laws or regulations that could impact your finances.

Regular financial check-ins are the key to staying on track and making continuous improvements in your financial life. They provide a framework for adjusting strategies, monitoring progress, and maintaining overall financial health, fostering long-term stability.

| Key Point | Brief Description |

|---|---|

| 💰 Budgeting | Track income/expenses to ensure you’re not overspending. |

| 🚨 Emergency Fund | Save 3-6 months of living expenses for unexpected events. |

| 💳 Debt Management | Prioritize paying off high-interest debt. |

| 📈 Investing | Start early and diversify investments for long-term growth. |

FAQ

Start by tracking your spending for a month to understand where your money goes. Then, create a simple budget using a spreadsheet or budgeting app, allocating your income to different categories like housing, food, and transportation.

A general guideline is to save 3-6 months’ worth of living expenses in your emergency fund. This will help you cover unexpected costs like medical bills, car repairs, or job loss without taking on debt.

Prioritize paying off debt with the highest interest rates first. Make minimum payments on all other debts, and put any extra money towards the debt with the highest interest rate. This method saves you money in the long run.

You can start investing with a small amount of money by using micro-investing apps or investing in fractional shares of stocks or ETFs. These platforms allow you to invest with as little as $5 or $10.

You should review your insurance policies at least once a year, or whenever there are significant changes in your life, such as getting married, having a child, or buying a new home. This ensures your coverage still meets your needs.

Conclusion

Achieving financial stability is a journey that requires dedication, discipline, and informed decision-making. By implementing these 5 Personal Finance Tips for US Families to Achieve Financial Stability, you can take control of your finances, build a solid foundation, and secure your financial future. Remember to stay consistent, adapt your strategies as needed, and seek professional advice when necessary.